Flexibility

Planning skelets offer great flexibility in coverage of various product groups and at the same time detailed aspects of other products.

Meet QuantPlan

Software solution for cashflow projection of existing balance sheet including rollovers and new business with calculation of net interest income and profitability components calculations. Short video demonstration of what about is the QuantPlan system.

Used by

controlling, asset-liability management

Blazingly fast

thanks to highly optimized and fine-tuned algorithms

Extraordinary tested

by numerous automatized tests of various kinds

Core Features

Version 1.0 offers balance sheet projection, net interest income and structural contribution components calculations for budgets and forecasts including the prepayment models. Future versions will add several equation builders to enable usage of custom functional relations in projections and more liquidity measures.

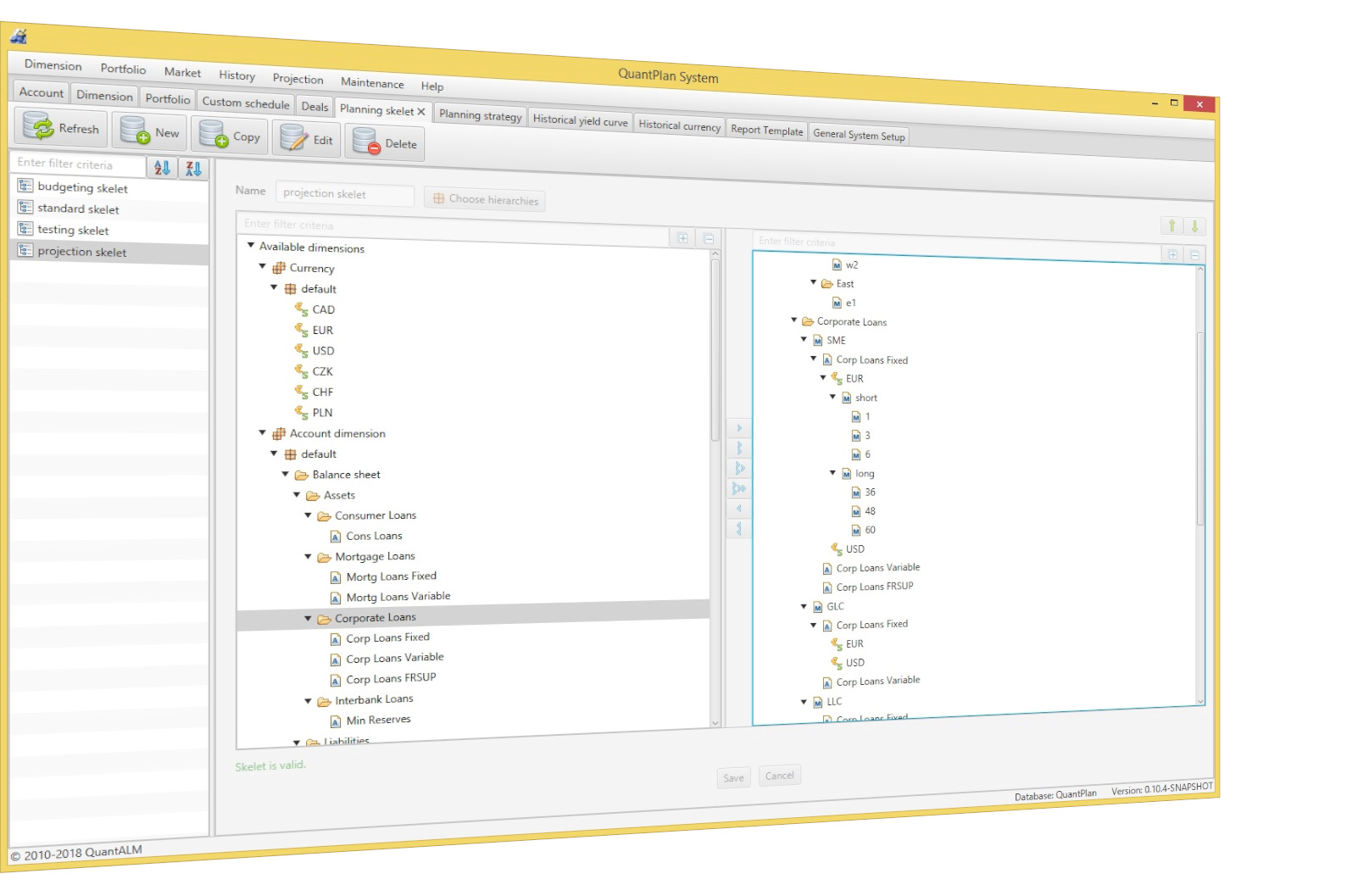

Planning skelet

- built from existing dimensions in the system

- presents the skelet of planning strategy

- presents the basis for exporting the results in reporting templates

- video demonstration of a planning skelet creation process

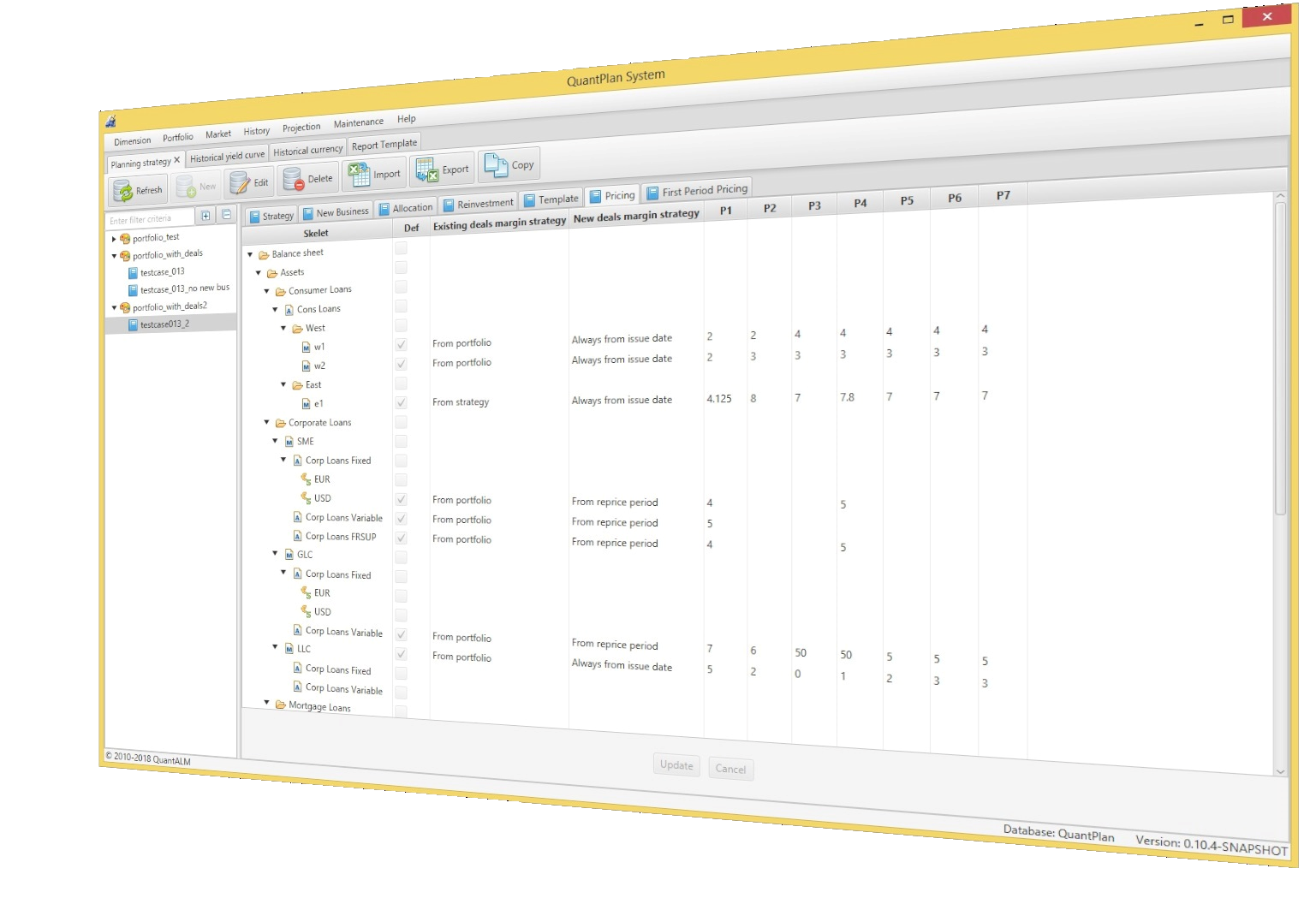

Planning strategy

Defines how current balance sheet (defined in portfolio) should be enriched with new business via:

- new volumes prescription (incremental or target)

- reinvestment rules

- allocation rules

- contractual features of new business

- pricing of new business

- short video demonstration of a work with the new business

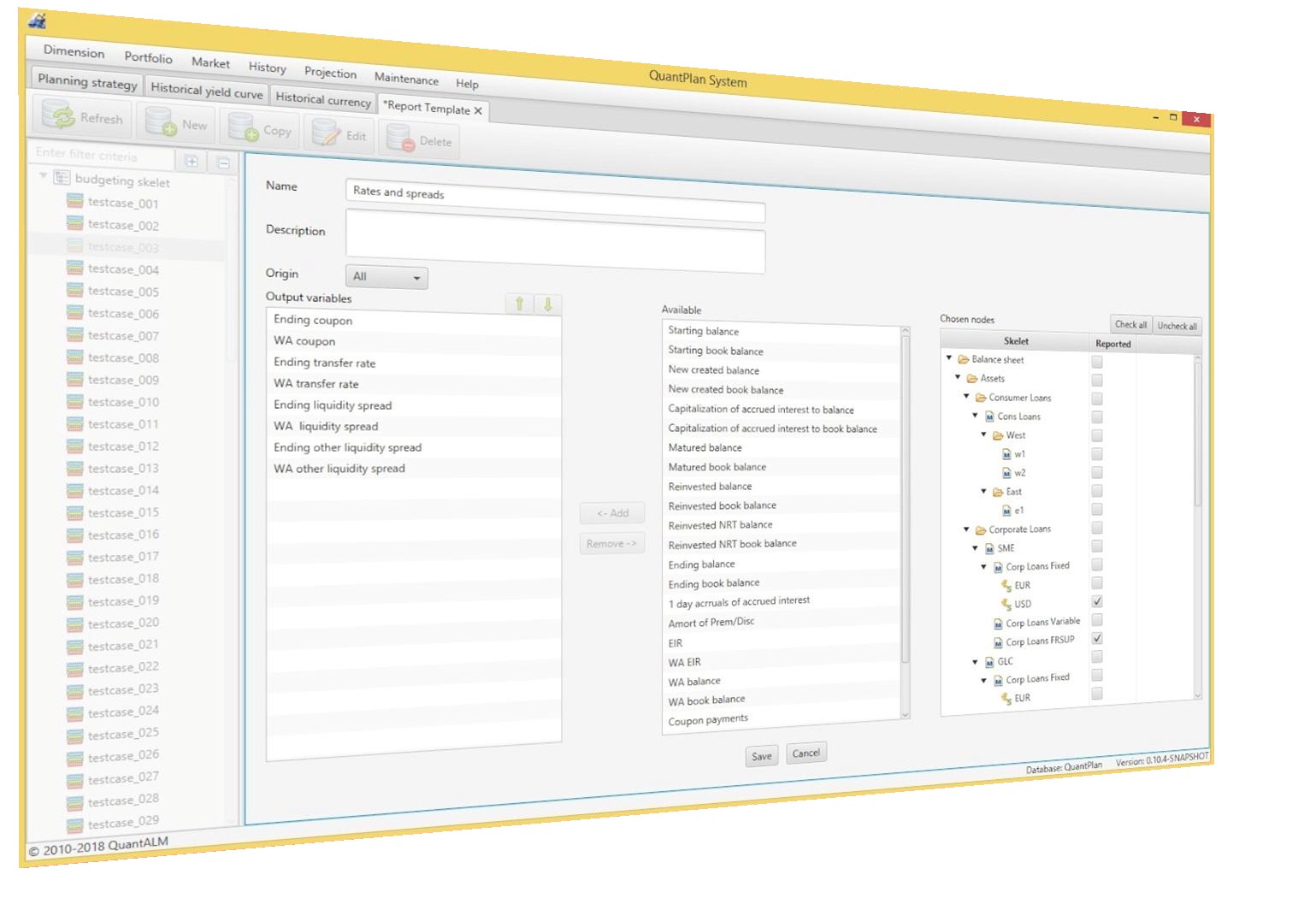

Reporting

- reporting templates based on planning skelets

- daily or monthly results

- Excel based exports

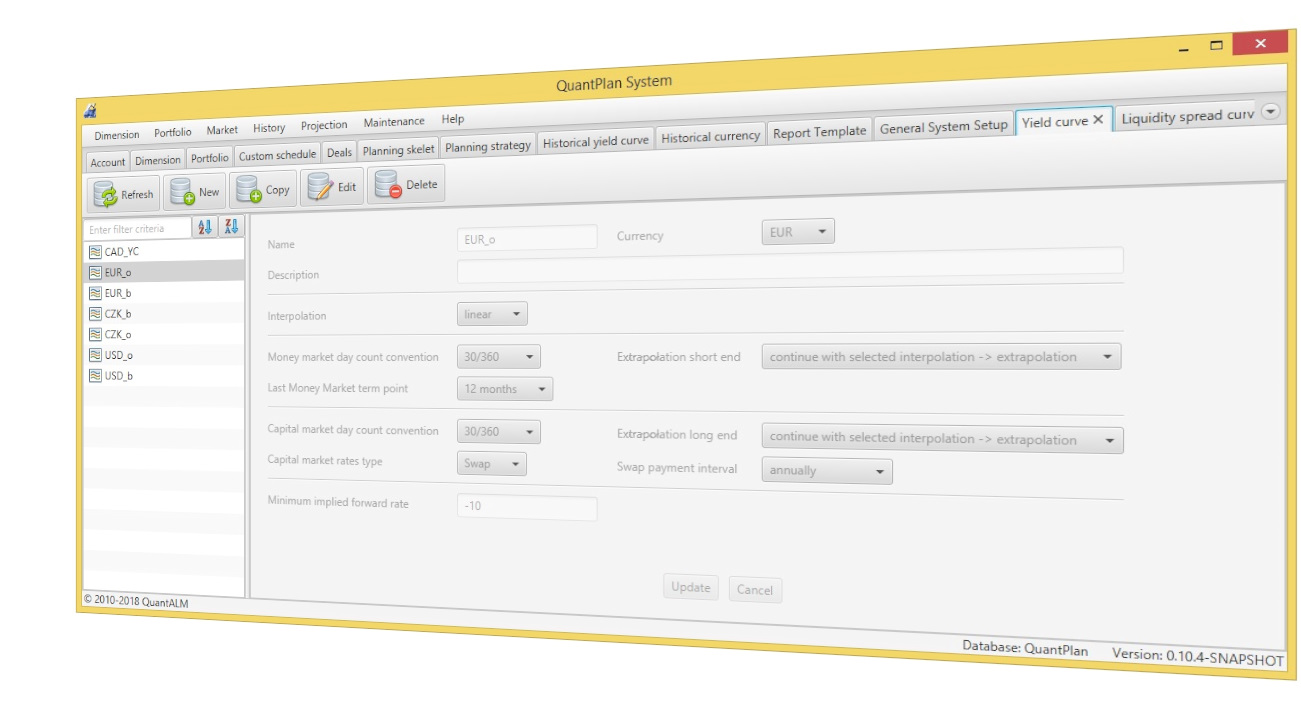

Market data

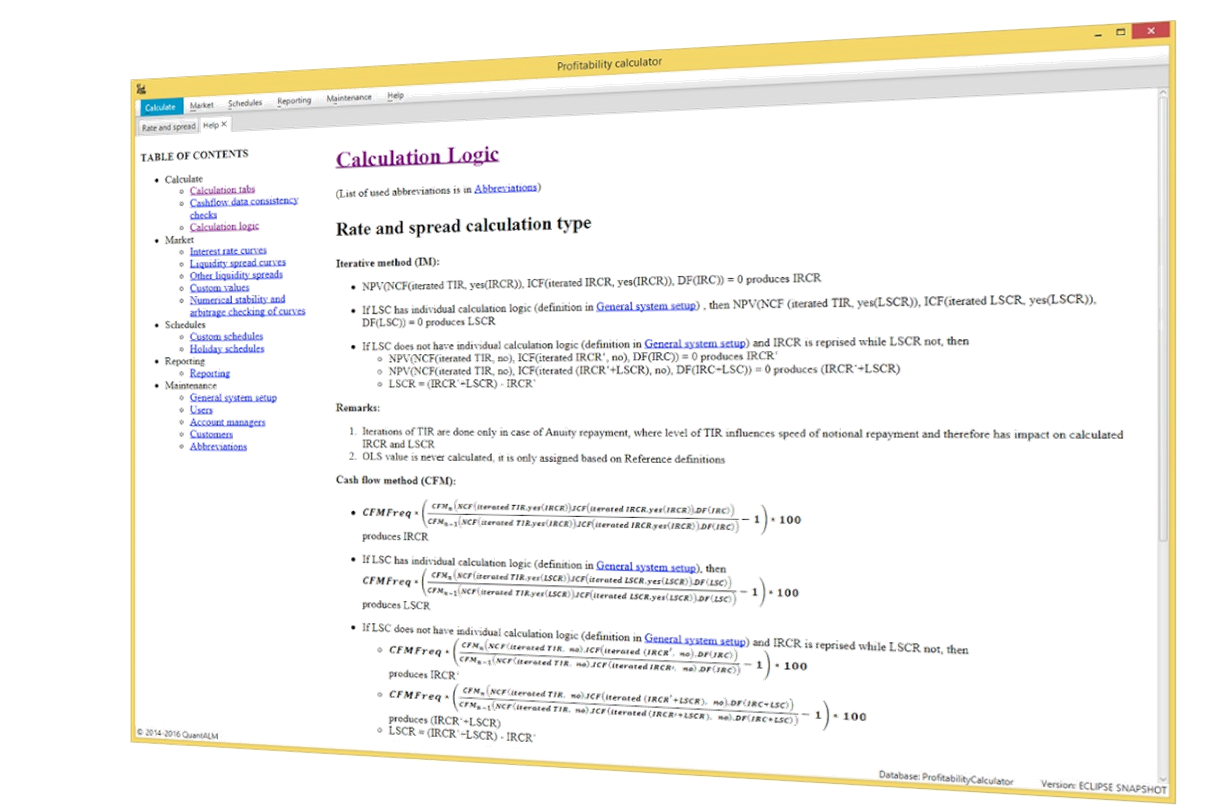

- industry standard work with interest rate curves and liquidity spread curves - available features, calculation procedures.

- possibility to use various type of market data scenarios

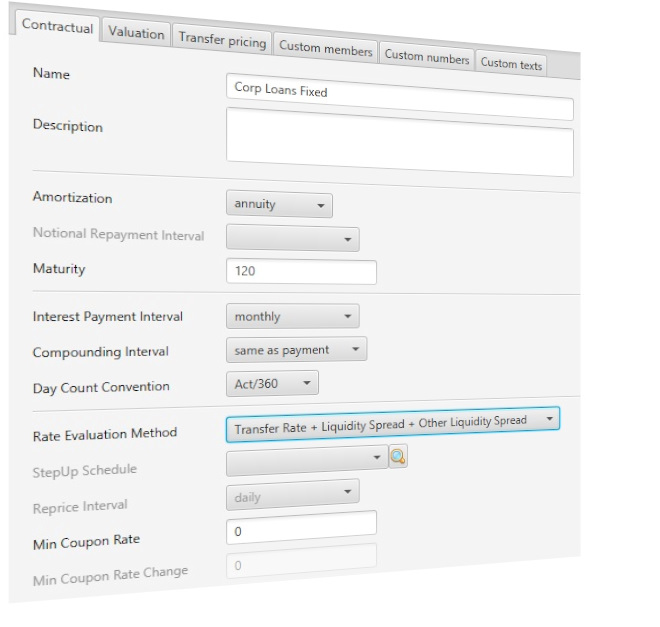

Transfer pricing components

- determined by client coupon

- coupon is function of transfer pricing components

- or lives its own independent life

User friendly interface

Main GUI features:- fast navigation using the "Go to" button

- tree-, table- and list filtering

- built-in help

- user preferences

- multiple languages

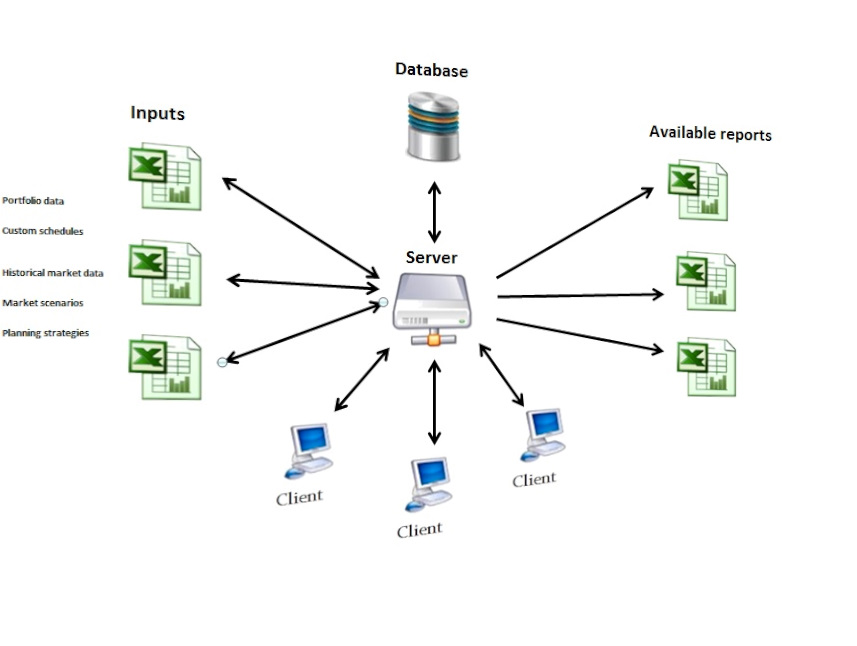

IT architecture

- written in Java (17+)

- using state-of-the-art libraries

- service oriented

- majority of databases supported

- stand-alone or client-server deployment

- running on Windows, Linux, MacOS

Automatized tests

- run every night

- include unit tests, integration tests, regression tests and GUI tests

- more than 550 single deal test cases (with sub-testing of support numbers – more than 1 million of individual numbers tested)

- more than 80 strategy projections test cases (with sub-testing of support numbers – more than 2.5 million of individual numbers tested)

- 99% coverage of the calculation logic code

Performance

- uses highly optimized algorithms

- a $1000 computer can calculate daily projection for next 5 years of middle size bank with portfolio aggregated into 100 000 deals in less than 3 minutes

- this calculation speed enables quick reiterations of whole process with modified input parameters